Insurance Licensing Services

Upgrade Your Strategy

Elevate your licensing strategy with the meticulous expertise of our seasoned team and the cutting-edge efficiency of our software, ensuring seamless and precise management of your compliance needs.

Minimize compliance risk

NLC Group empowers your business to thrive by expertly navigating the regulatory landscape, ensuring compliance risks are kept to an absolute minimum.

Expert outsourcing

Outsourcing with NLC Group liberates your time and resources, enabling you to concentrate on your core business strengths while we handle the intricacies of insurance license compliance with precision and care.

Provide visibility to compliance

Our cutting-edge alerts and notifications provide crystal-clear visibility to compliance, keeping you informed, empowered, and in control of your licensing landscape.

Provide cost-effective solutions

Our cost-effective solutions not only ensure comprehensive insurance license compliance but also provide maximum value, allowing your business to thrive without breaking the bank.

Compliance Checks

- License Verification

- DRLP Status

- Background Issue Review

- CE Status

- Daily NIPR Sync

- Agency Affiliations

- State Regulations

Cost-effective solutions.

Upgrade Your Strategy

Elevate your licensing strategy with the meticulous expertise of our seasoned team and the cutting-edge efficiency of our software, ensuring seamless and precise management of your compliance needs.

Minimize compliance risk

NLC Group empowers your business to thrive by expertly navigating the regulatory landscape, ensuring compliance risks are kept to an absolute minimum.

Compliance Checks

- License Verification

- DRLP Status

- Background Issue Review

- CE Status

- Daily NIPR Sync

- Agency Affiliations

- State Regulations

Expert outsourcing

Outsourcing with NLC Group liberates your time and resources, enabling you to concentrate on your core business strengths while we handle the intricacies of insurance license compliance with precision and care.

Provide visibility to compliance

Our cutting-edge alerts and notifications provide crystal-clear visibility to compliance, keeping you informed, empowered, and in control of your licensing landscape.

Provide cost-effective solutions

Our cost-effective solutions not only ensure comprehensive insurance license compliance but also provide maximum value, allowing your business to thrive without breaking the bank.

Cost-effective solutions.

What our clients have to say

insurance license management for...

Carriers

Authorize your appointees with confidence through NLC Group’s carrier management, ensuring precision and compliance every step of the way.

Discover more

Agencies

Empower your agency with NLC Group’s management solutions, guaranteeing that producer/adjuster and agency licenses are meticulously maintained.

Discover more

MGAs

Navigate license and E&O requirements seamlessly with NLC Group’s MGA management, ensuring sub-producers meet and exceed standards.

Discover more

Contact Centers

Optimize call center efficiency with NLC Group’s contact center management, confirming that agents not only meet but exceed compliance requirements.

Discover more

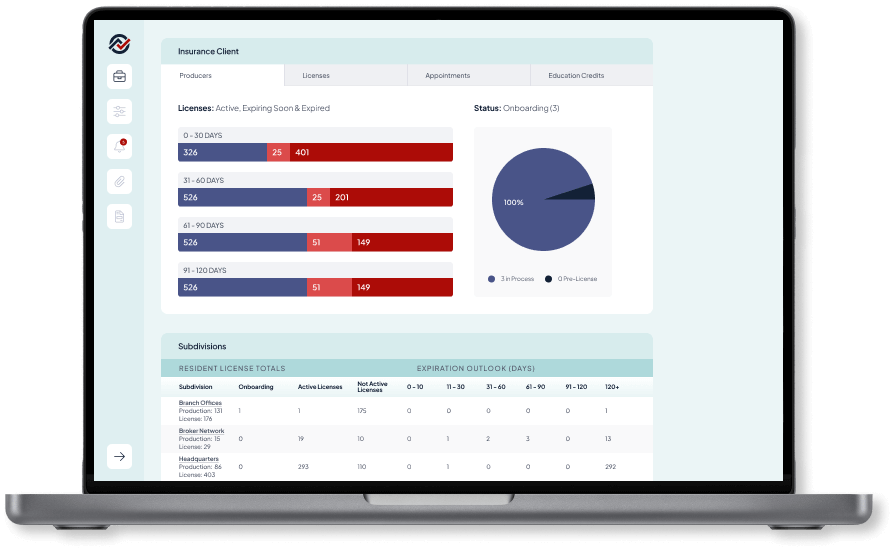

NLC Group Software solution

Elevate your insurance agency’s licensing game through NLC Group’s cutting-edge ART Solution – a comprehensive tool for proactive license tracking, ensuring you stay ahead of compliance dates effortlessly.

Discover more

Benefits of working with NLC Group

Overall Cost Reduction

Significant Productivity Gains

Smarter Enterprise Decision Making

Proactive Risk Management

Scalability and Flexibility for Future Growth

Secure Controlled Solution with Repository

Centralized Enterprise Management Portal

Insurance Licensing Services

As specialists supporting the insurance services industry, we ensure that agency and carrier licensing and appointments are in compliance.

NLC Group Experts have developed services to uniquely address the insurance licensing needs of Insurance Brokers, Managing General Agents (MGA), Insurance Carriers, and Contact Centers Selling Insurance.

New Licenses

NLC Group accelerates the process of obtaining new licenses, ensuring a swift and efficient onboarding experience that aligns with the dynamic needs of the insurance industry.

License Renewals

Renew with ease through NLC Group’s streamlined process, ensuring timely and hassle-free license renewals. Stay compliant without the stress, thanks to our expert management of the renewal lifecycle.

License Appointments & Terminations

NLC Group simplifies the complexities of managing license appointments and terminations, ensuring a smooth and efficient process that aligns seamlessly with your business dynamics.

Name & Address Changes

Handle changes with ease. NLC Group provides a user-friendly solution for updating names and addresses, allowing you to keep your licensing information accurate and up-to-date effortlessly.

Automatic Proactive Alerts

Stay ahead of compliance deadlines with NLC Group’s automatic proactive alerts, ensuring you’re informed well in advance of renewals, continuing education requirements, and any regulatory changes impacting your licensing.

CE Tracking

NLC Group’s CE tracking feature guarantees your team stays on top of continuing education requirements, offering a seamless way to monitor, manage, and fulfill educational obligations.